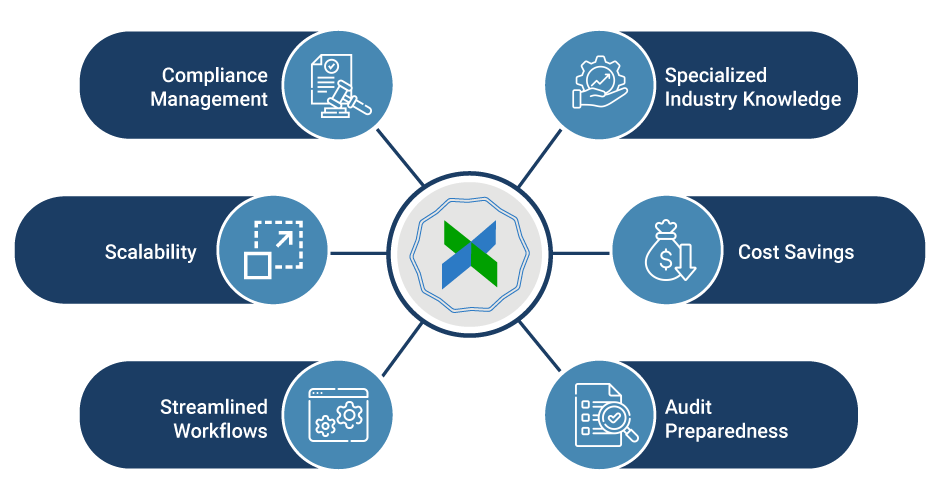

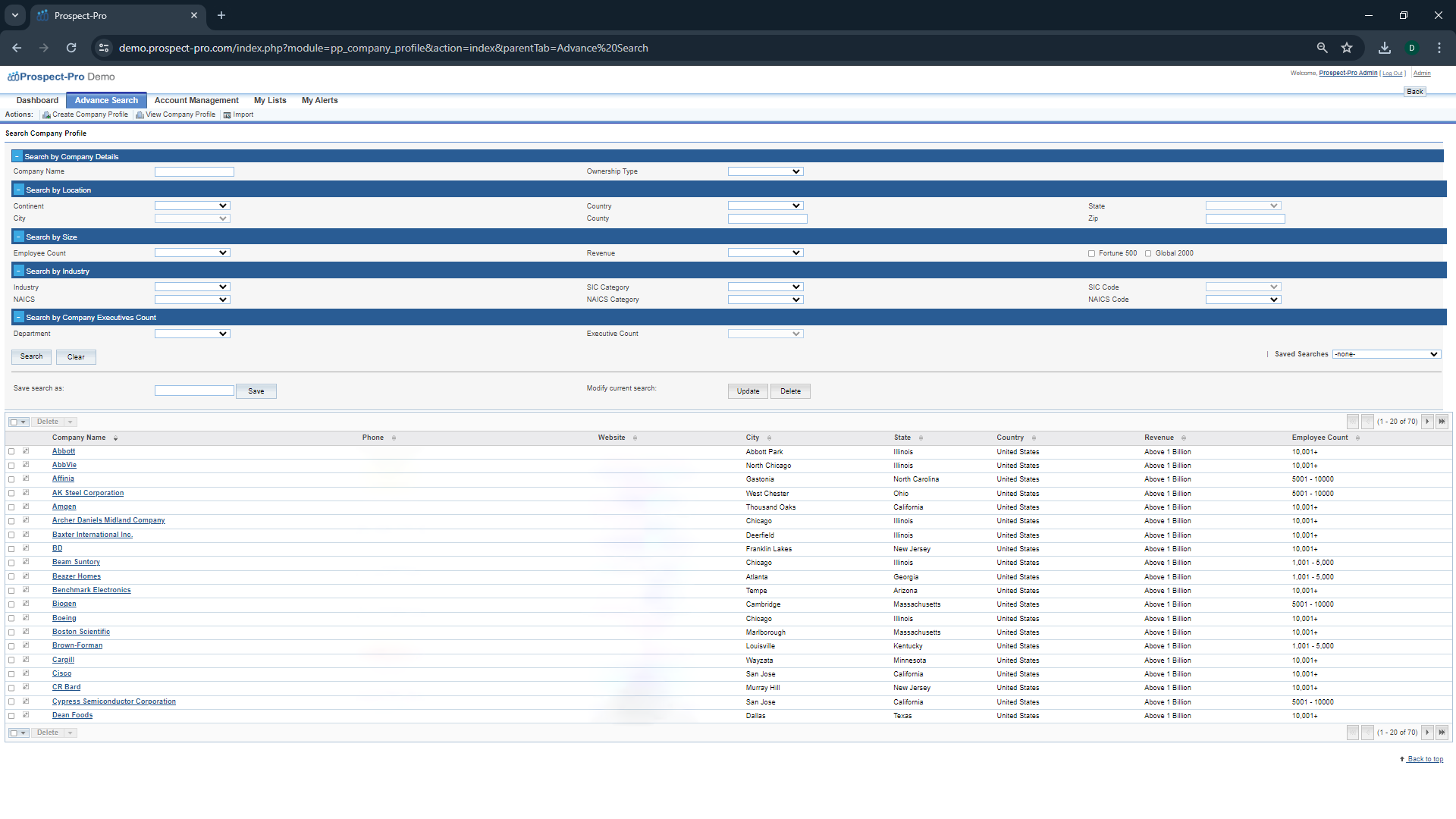

About IntelleTax - Indirect Tax Filing

Comprehensive Indirect Tax Filing Services

Staying compliant demands precision, up-to-date knowledge, and efficient handling of indirect taxes.

Our Indirect Tax Filing service offers comprehensive support, including accurate tax calculations based on jurisdiction, preparation and filing of returns, and staying updated with the latest regulatory changes to ensure compliance and reduce the risk of penalties or audits.